Asset Allocation – Importance in an investment portfolio

Have you heard the popular saying “ Don’t put all your eggs in one basket”?

Imagine you carrying a basket of eggs and you didn’t see a pothole on your way. And the next thing you realize that you lost your balance and broke all your eggs. And that is going to hurt.

Asset Allocation simply is the process of diversifying your investments across various asset classes like Equity, Debt, Cash, Gold, Real Estate, and many more to reduce overall risk. Asset Allocation ensures all your eggs are not in the same basket thus diversifying your investment risk. Not all asset class moves in the same directions and if one asset falls, the other asset can compensate for its fall.

Different Asset class performs differently based on macroeconomic and market condition. It’s advisable to allocate your asset wisely and combine assets to lower the overall portfolio fluctuations and consider things like an emergency during the allocation mix so you don’t have to dip in your investments.

Scenario 1

You don’t feel asset allocation makes any difference to your investment decision. Hence you decide to randomly invest your money Rs 1,50,000 in 80% in Gold and 20% in deposits. You have met with some emergency and need cash urgently.

Assuming gold prices have dropped, you are not left with many choices but to liquid your deposits which might attract some penalty or sell your gold investment and book losses.

Scenario 2

Now consider a situation where you have invested your money wisely Rs 1,50,000 across various asset classes like 15% Gold, 20% Company deposit, 60% Equity Mutual Fund, and 5% Savings account or Liquid Fund. Taking the same example as above, you have met with some emergency and you need cash urgently.

You can simply withdraw your money from your saving accounts or liquid fund without dipping in your investments. Also, assuming the gold prices have dropped and the equity market is performing well. You would notice that the drop in the price of gold is compensated with an increase in the price of your equity investments. Thus protecting your overall portfolio.

Advisers and wealth managers have built asset allocation models to suit all kinds of investors. Asset Allocation is done based on your risk profiling or nearness of your goals or market conditions.

Just simply saying you understand risk is not the right approach. Risk profiling is the first step toward investing and it’s important to understand your risk i.e. Willingness and capacity to take the risk. Risk profiling is based on behavioral and psychometric testing.

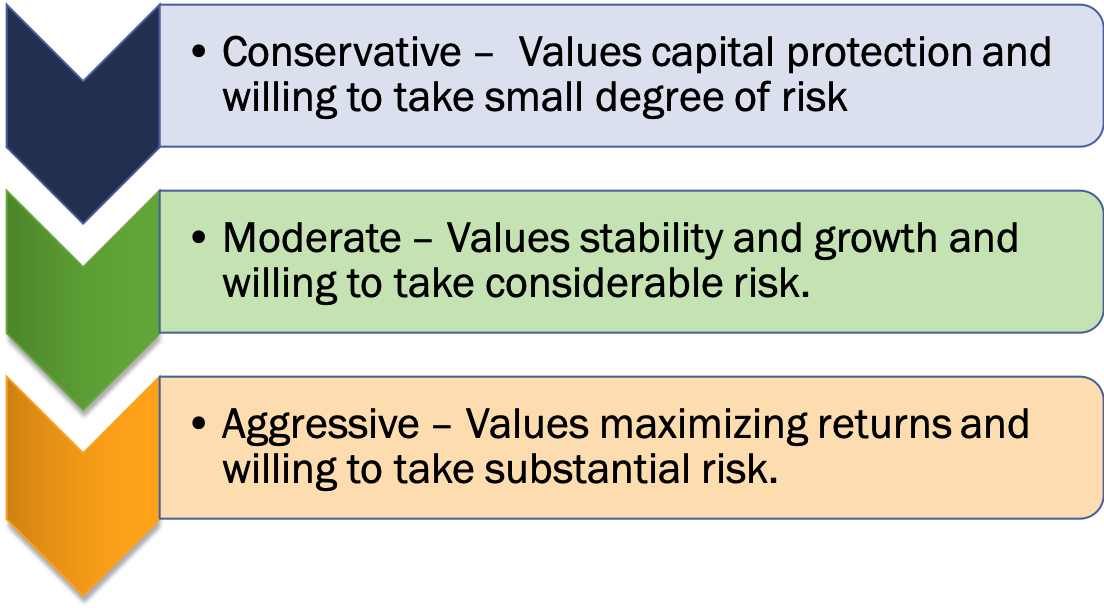

Once you have done with your risk profiling, you can decide what kind of investor you are, returns you expect from investments, market volatility you can tolerate, and portfolio suitable for you. Upon risk profiling test completion, you will be put into one of the risk buckets. Broadly there are three risk buckets based on which one can allocate wisely.

You can also allocate your asset based on the nearness of your goals. Suppose you have invested in equity mutual funds to create a corpus to support during your golden years. As you approach your retirement age, it’s advisable to switch the corpus systematically from equity to debt. Similarly based on the macroeconomic and market condition one can take a call on certain asset classes and within to generate better returns.

Generally, Retails inventors fail to appreciate the massive benefits asset allocation can have on their investment portfolio. You can lower overall risk i.e. possible outcomes you don’t have control over. You can rebalance your portfolio based on the macroeconomic and market condition to generate better returns or any drift in your portfolio.

Rebalancing helps you to realign the portfolio such that the exposure is increased in an underweight asset and reduced in an overweight asset with the same risk-reward expectations in your portfolio despite a change in the market situation.

Usually, retail investors don’t care much about allocations and change it often following external events. Their personal biases take control of their investment decisions over well-defined models.

Sadly, this happens when they need to discipline the most. Often, they become either too greedy when markets are going up or fearful when the market is going down. And that is the reason why most of the investor ends up buying in market peak and sell during the market bottom. In reality, they should have done exactly the opposite.

Some even add more to the already overweight asset class increasing the risk or redeem their existing investments instead of buying. Personal biases trigger multiple human emotions and investors usually end up with no so prudent financial decision only to regret later.

Key Takeaways

1. Unlearn your personal biases and follow disciplined investing.

2. Risk profiling is the first step toward investing hence understand your risk profiling well.

3. Allocate your asset wisely based on your risk profiling, or nearness of your goals or market condition.

Disclaimer

No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor before making any actual investment or trading decisions. All information is a point of view and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

While we may talk about strategies or positions in the market, our intent is solely to showcase effective risk-management in dealing with financial instruments. This is purely an information service and any trading done based on this information is at your own risk. The information provided by Marketgoogly through its public channels such as Facebook posts, Tweets, LinkedIn, Telegram, WhatsApp, and YouTube is for educational purposes only and is not investment or tax advice.

Comment / Discussion