Kya Hain Mutual Fund ??

Thanks to the mutual fund commercials on TV with popular slogans like “Mutual fund Sahi Hain “and increasing investor awareness. Everyone is talking about the mutual fund today.

Although it prompts you to think for your financial future, the moment you think about the investment you get butterflies in your stomach. So many questions run through your mind like what if I lose my hard-earned money or do, I understand mutual fund and how does it works and many more.

Kya Mutual fund Sahi Hain??

We have grown up with a fixed deposit, land, insurance, and gold as our holy grail of investment. Moving away from these into other financial products such as mutual funds, equity, commodities, debt, etc. meaning getting out of our comfort zone.

First, you need to understand your risk tolerance, the purpose of your investment, how long you want to invest, and how much you need to invest today to achieve your financial goals. Once you understand the basics of investing, you will feel more comfortable investing and exploring new financial products that generate better returns in comparison with traditional investment options.

There are roughly over 2000+ mutual fund scheme and if you remain invested in the mutual fund for long term your potential return will be higher than a fixed deposit.

If you want to invest, you can opt for different investing routes like do your own investment or opt for an investment adviser or invest via Mutual funds.

1. Do your research – Some people shy away for investing as they don't have adequate knowledge or they feel finance is too complicated. All it just takes common sense and some time to get finance. Once you understand the basics of investing there is no looking back. However, we cannot deny the fact it’s a time-consuming process, and knowledge takes time. The probability of choosing the wrong stock or mutual fund schemes is higher without the right knowledge.

2. Adviser – You may opt for an investment adviser. However, if you have less money to invest like 500 per month paying fees can be slightly denting on your pockets.

3. Mutual Fund – Here comes our knight in Shining Armor. If you don’t have time or adequate knowledge for research or you want an expert to manage your money you may choose to invest your savings in Mutual funds. Mutual Fund house appoints fund manager with a proven track record who manages the fund for a low fee and invest based on the scheme common investment objective.

So what is mutual fund after all and how does it work?

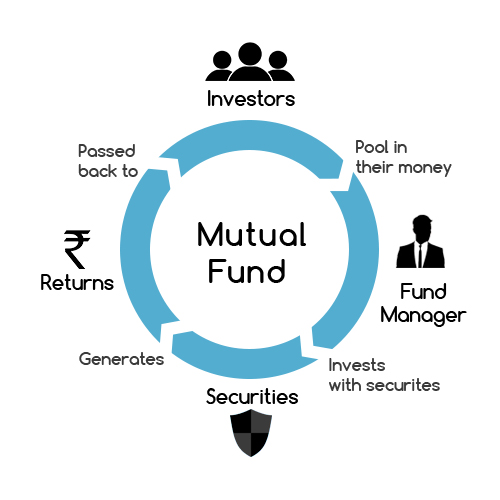

Mutual Fund is a professionally managed investment fund that pools money from many investors to purchase the securities.

One of the common misunderstanding is that you can only invest in equity through Mutual Fund. However, you can invest in equity, debt, gold, real estate, and not just equity.

Let’s deep dive into equity mutual funds. A mutual fund that invests in the equity market or stock market is nothing but equity mutual fund. Suppose you have Rs 15,000 and you want to invest in the equity market and you liked MRF share and the current market price of the share is Rs 57,800. So, what should you do now?

Don’t worry the Knight in Shining Armor comes again for your rescue. You can instead choose to invest in a mutual fund scheme that has MRF exposure.

A mutual fund is set up in the form of a trust. Trust can be established by a sponsor who is like a promoter of a company. Trusts appoint Asset Management Company (AMC) which is approved by SEBI who in turn appoints a fund manager and manages the funds by making investments in various types of securities.

Mutual fund pools money from investors and create a corpus which is nothing but Asset under management (AUM) with a common investment objective. Let say, Mutual fund collects Rs 1000 from 150 investors each like you and me and buys 3 shares of MRF. There are 150 investors now and fund house has only 3 MRF shares, so how they are going to ensure fair distribution?

Well, Mutual fund house distributes in from of units based on the amount invested by individual investors. If you wish to redeem your investments you can easily do so as they are liquid. A mutual fund is regulated by SEBI and AMFI and hence you don’t worry about the fund closure.

By opting for a mutual fund, you are now a proud owner of MRF which was not possible otherwise. Hence by investing in a mutual fund, you can now have a well-diversified portfolio of stocks with less amount of investment.

Benefits of investing in Mutual fund

Power of compounding: Mutual funds harness the power of compounding. Compounding is the interest that you earn on interest. Hence, the value of your investment keeps growing at an ever-increasing rate.

Diversification of risk: One of the key benefits of investing in a mutual fund is diversification. Not every asset moves in tandem; while some rise, others fall. So, when you own both the stocks in your portfolio, any losses from one are canceled out by the gains in the other not exactly offsetting though. Thus, diversification reduces your overall risk.

Professionally managed fund: Mutual fund house appoints fund manager with a proven track record who manages the fund and in turn charges a nominal fee which is known as expense ratio which is roughly around 1-2%.

Auto Investment: You can set up a one-time SIP mandate and set monthly auto-debit for your mutual fund investments.

Liquidity: Open-ended mutual funds allow investors to redeem their units at any time at the prevailing NAV. So mutual funds are highly liquid, which is beneficial for investors.

Drawbacks of investing in Mutual fund

Redemption Pressure –Fund managers can manage fund but they don’t have the power to invest or redeem. if the investor gives money they invest and if they need their money back, they have to redeem. During Market crash even if the market fund manager wants to invest but individual investor wants to redeem, the fund manager doesn’t have a choice. They have to sell the security in loss and payback to the investor. Hence during market crashes funds may face redemption pressure which will result in a loss in NAV for existing investors.

Agent Commissions: - Regular mutual fund agents earn 1-2% on your investment amount, however, you can save the commission by investing in direct mutual funds for a higher return.

Marketing Gimmicks–Fund house wants to ensure maximum assets under management and hence they resort to aggressive marketing tactics for their scheme. One should carefully pick the scheme based on their risk profiling, financial goals, investment objective, etc.

If you wish to continue the financial learning journey with us and learn A-Z of the mutual fund like types of mutual fund, how to pick scheme, SIP or lumpsum investment, how to invest, and many more.

Stay tuned for more updates. Until then …. Adios from Marketgoogly:)

Disclaimer

No content on this blog should be construed to be investment advice. You should consult a qualified financial advisor before making any actual investment or trading decisions. All information is a point of view and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

While we may talk about strategies or positions in the market, our intent is solely to showcase effective risk-management in dealing with financial instruments. This is purely an information service and any trading done based on this information is at your own risk. The information provided by Marketgoogly through its public channels such as Facebook posts, Tweets, LinkedIn, Telegram, WhatsApp, and YouTube is for educational purposes only and is not investment or tax advice.

Comment / Discussion